Investment Terminology

Accredited Investor

An Accredited Investor is defined by the Securities Act as any natural person whose individual net worth exceeds $1M, excluding the value of their primary residence, or has an annual income in excess of $200,000 ($300,000 with spouse) in each of the two most recent years and who reasonably expects an income in excess of $200,000 ($300,000 with spouse) in the current year.

Read More

These are other definitions of an Accredited Investor that can be found by clicking the following link:

Cash on Cash (CoC) Return

CoC is an annual rate of return and some refer to it as the cash yield. It is calculated by dividing annual cash distributions made to investors by their invested capital.

Read More

Sponsors often present CoC as an averaged value over an asset’s holding period. Since CoC calculations do not discount future cash distributions to present value, it is a less important measure of investment returns than IRR.

Capital Expenditure (CAPEX)

CAPEX are expenditures made for replacements, upgrades, or major repairs to an income property that are depreciated over their useful life.

Read More

Examples of common replacements include roofs and HVAC equipment. Common upgrades are new landscaping, signage, lighting/security systems, flooring, fixtures, and finishes while major repairs are made to parking lots, exteriors, windows/doors, gutters/drainage systems, etc.

Capitalization Rate (cap rate)

The cap rate is calculated by dividing a property’s net operating income (NOI) by its sales price.

Read More

We first evaluate a potential acquisition using cap rate analysis, and if it appears attractive, then we proceed to discounted cash flow analysis.

Capital Structure

The capital structure is the proportion of equity and debt in a deal.

Read More

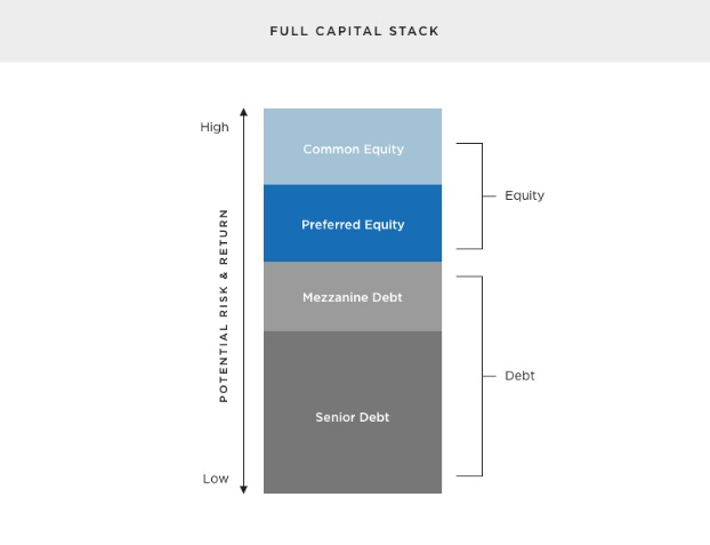

Capital Stack

The capital stack is a visual representation of all sources of capital used to finance a real estate acquisition.

Read More

Each source of capital has a different priority when it comes to receiving payment from the property’s NOI. These are stacked up from the lowest risk-return (senior debt) to the highest risk-return (common equity) as shown in the graphic below.

Commercial Real Estate (CRE)

CRE is income-producing property used exclusively for business-purposes or multi-family properties containing more than four units.

Read More

1) Office

2) Industrial Use

3) Multi-Family (apartment complexes)

4) Retail

Cost Segregation

Cost segregation is a tax deferral strategy based upon accelerated depreciation. A cost segregation study categorizes a property’s improvements into specific asset classifications with most having shorter depreciation recovery periods as compared to depreciating the property’s improvements as a whole.

Read More

Good candidates for cost segregation are newly acquired or renovated properties valued at over one million dollars that have an expected holding period of at least five years, and numerous asset components eligible for re-classification to depreciation recovery periods of 5, 7, and 15 years. Without cost segregation, all property improvements are depreciated over 39 years.

If we is believe cost segregation will benefit a deal then we will commission an engineering company to evaluate the property and produce a cost segregation study after all planned improvements are made to the property.

Debt Coverage Ratio (DCR)

DCR measures the ability of a property’s net operating income to cover its mortgage payment. DCR is calculated by dividing a property’s NOI by its debt service payment.

Read More

Discounted Cash Flow (DCF) Analysis

Discounted cash flow analysis is a valuation method that seeks to determine the profitability of an investment by forecasting future cash flows and then discounting them back to present value. The method is based upon the principles of compounded interest.

Read More

Due Diligence

Due diligence is the process of discovery and analysis that starts when the property goes under contract and ends with the acquisition’s closing.

Read More

Equity Multiplier (EM)

EM equals the total cash distributions made to investors divided by their invested capital.

Read More

Gross Income Multiplier (GIM)

GIM is a common ratio used for comparing values of similar properties using the income approach. GIM is calculated by dividing a property’s sales price by its potential annual gross income.

Read More

Potential Gross Income (PGI)

PGI is the total rental income at 100% occupancy plus all sources of ancillary income.

Read More

Ancillary income comes from laundry rooms, vending machines, application fees, parking, net deposits, and so on.

Internal Rate of Return (IRR)

IRR is the annualized interest rate that makes the present value of all cashflows equal the invested capital in a discounted cash flow model.

Read More

Leverage

Leverage is debt divided by the sum of equity and debt in a deal.

Read More

Loan-to-Value (LTV)

LTV is the ratio of the loan amount (or outstanding principal) to the purchase price (or market value) of a debt-financed CRE deal.

Read More

Most CRE deals are underwritten with the LTV between 60-75%. The risk of loan default increases with higher LTV values.

Net Cash Flow

Net Cash Flow is the net of all cash flows within a business (i.e., from operations, investing, and financing activities) within a specific reporting period.

Read More

Positive net cash flow represents cash flow available for distribution to the investors. A portion of net cash flow may be retained to establish cash reserves as is often required by lenders. Most sponsors have set policies for the amount of cash reserves they hold in a deal.

Net Operating Income (NOI)

NOI is the annual cash flow derived from the operating activities of an income-producing property.

Read More

Private Placement Memorandum (PPM)

PPM is a set of legal documents given to potential investors that introduces an investment and discloses everything an investor needs to know to make an informed investment decision.

Read More

The individual documents include a subscription agreement, investor questionnaire, operating or limited partnership agreement, and a complete business plan that includes financials, risks factors, market analysis, contingency plans, management fee structures, operating plans, CAPEX plans, and so on.

Return on Investment (ROI)

ROI is the sum of all cash distributions made to an investor divided by their invested capital.

Read More

Syndication

A real estate syndication is the pooling of capital from passive investors (or limited partners) to purchase commercial real estate. The deal sponsor (or general partner) sources the deal and has a fiduciary responsibility to define the returns and risks for the investors, and if the deal closes to manage and protect their investment.

Read More

The benefit of syndication is that a group of investors can pool their capital to acquire more and/or bigger properties than they could individually. This provides both greater investment diversification and economies of scale. Furthermore, the sponsor is a professional manager with the expertise, resources, and systems to manage the asset, while the investors (or limited partners) are freed from any active role and their liability is limited to their invested capital. The sponsor collects management fees and can participate in profit-sharing splits if expected returns are realized.

Underwriting

Underwriting is when the deal sponsor evaluates an acquisition target to determine if it is a financially attractive deal and if it aligns well with the sponsor’s investment strategy and management capabilities.

Read More

As HAPGOOD CAPITAL, we follow a standardized underwriting process. The output from the underwriting process goes into a standardized business case template, which includes property details, market analysis, financial projections, and specific plans to manage and improvement the property.